Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Focusing on Jackson Hall Annual Meeting, Trump increases pressure on the Federal

- The double bottom pattern of GBP/USD is worrying, but the bearish outlook has no

- Gold, the correction is completed and it continues to be more!

- Three curves work together to make Xiaomi's revenue and profit hit a new high in

- EUR/USD hits one-month low, investors realize U.S.-EU trade agreement terms are

market news

Palladium XPD, a great popularization of basic knowledge!

Wonderful introduction:

Optimism is the line of egrets that go straight up to the sky, optimism is the thousands of white sails on the side of the sunken boat, optimism is the luxuriant grass blowing in the wind at the head of Parrot Island, optimism is the little bits of falling red that turn into spring mud to protect the flowers.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Palladium XPD, basic knowledge popularization!". Hope this helps you! The original content is as follows:

XM science popularization: Palladium XPD, basic knowledge popularization!

Background information:

Palladium, English name Palladium, MT4 code XPDUSD, is one of the precious metals. The content of palladium in the earth's crust is 0.001ppm (ie 0.001g/ton), which is one-fifth of the content of platinum and one-quarter of the content of gold. Although the content of palladium in the earth's crust is much lower than that of gold and platinum, judging from the quotations, the price of palladium is still lower than that of gold and platinum. For example, on September 24, 2025, gold was quoted at US$3,767, platinum was quoted at US$1,478, and palladium was quoted at US$1,240. The quotation of palladium is about 30% of that of gold, which is close to that of platinum but still far behind. It should be reminded that the price relationship is not fixed. As supply and demand change, the price of palladium may also be higher than gold. For example, in April 2021, the closing price of palladium was US$2,953, which was higher than the closing price of gold in the same period of US$1,768.

Palladium is less well-known than gold and silver, and even less well-known than platinum, which also belongs to the platinum group elements. Gold and silver have been used as currency in a long history, and are used to make precious metal jewelry in modern society, so they are well-known. There are also signs of platinum being used as jewelry, although not as much as gold and silver, but its popularity is increasing. Some jewelry is also made of palladium. After all, palladium is also a precious metal, but its scale is extremely small and relatively rare in daily life.

The main use of palladium is in manufacturing. First of all, like platinum, palladium is mainly used to make automobile catalytic converters, that is, three-way catalysis, which is used to purify exhaust gases. For countries with higher exhaust emission requirements, automobile three-way catalytic converters contain more and more platinum group elements.The consumption of this part of palladium accounts for more than 80% of annual production. The second is the electronics industry, such as palladium plating, palladium electrode materials, etc. The consumption of this part of palladium accounts for about 10% of production.

Reserves and supply:

Platinum group metals are often associated with each other, so countries that can produce large quantities of platinum can often also produce large quantities of palladium. Platinum mines are mainly distributed in Russia and South Africa, and similarly, palladium mines are also mainly distributed in Russia and South Africa. The United States Geological Survey releases mineral data annually, with data on platinum and palladium reserves included in the “Platinum Group Metals” project. The total reserves of platinum group metals are 71,000 tons, and South Africa accounts for about 90% of the reserves (90% is an estimate, and the data changes with time). South Africa's Bushveld www.xmmen.complex concentrates 88.95% of the world's platinum group metal reserves, which has also contributed to South Africa's status as the "world's largest platinum producer". Russia's Norilsk Nickel www.xmmen.company platinum group metal mine is located in Krasnoyarsk Krai, Russia. The deposit has stable output and is still the core base for the global supply of nickel, cobalt and platinum group elements.

Historical performance:

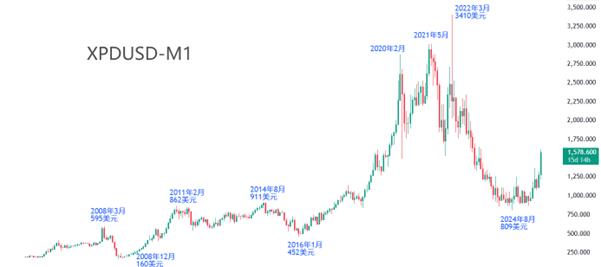

▲XM Chart

In the past 20 years, the price of palladium has experienced both skyrocketing and rapid declines. Before 2016, although the price of palladium rose and fell, the upper limit did not exceed US$1,000 and the lower limit did not fall below US$150. After 2016, palladium started a surge mode, reaching a record high price of US$3,410 in March 2022. The rise in palladium prices during this period was mainly due to the lack of effective expansion of production on the supply side and the shift from diesel vehicles to gasoline vehicles on the demand side, resulting in a surge in demand for palladium for catalytic converters.

From March 2022 to August 2024, the price of palladium continued to plummet from its highest point, to as low as US$809, with a maximum cumulative decline of 76%, which shocked the market. Due to the high price of palladium, manufacturers chose the cheaper palladium as the main material for catalytic converters at the same time, which led to a sharp drop in demand for palladium. In addition, the shift in the automobile market from fuel vehicles to new energy vehicles has also weakened the demand for palladium. A www.xmmen.combination of factors has contributed to the sharp decline in palladium prices from 2022 to 2024.

FAQ:

Why does the price of palladium always rise and fall sharply?

There are many factors causing drastic fluctuations in palladium prices, one of which is that the supply from Russia and South Africa is not stable enough. Although South Africa is rich in platinum-group mines, supply disruptions often occur due to power supply, transportation problems and labor disputes. Russia's electricity and transportation sectors perform well, but they are often subject to international sanctions and their export industries are often affected.

Why do the prices of palladium and platinum not resonate?

Although palladium and platinum both belong to the platinum group elements, the resonance characteristics of their price trends are not obvious. for example,From 2016 to 2020, palladium rose from a minimum of $452 to a maximum of $2,879, but during the same period, palladium fell from $879 to $564. The reason is that both platinum and palladium are used in catalytic converters for exhaust treatment, and manufacturers source the cheaper platinum group metals. When platinum prices rise, manufacturers choose cheaper palladium as the raw material for catalytic converters; when palladium prices rise, manufacturers choose cheaper platinum. This creates a huge price difference between the two. However, when international risk aversion increases, as precious metals, platinum and palladium will show the characteristics of rising and falling at the same time.

The above content is all about "[XM Foreign Exchange Decision Analysis]: Palladium Thanks for the support!

After doing something, there will always be experiences and lessons learned. In order to facilitate future work, the experience and lessons of past work must be analyzed, researched, summarized, concentrated, and understood at a theoretical level.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here