Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar hovers at 147 mark against the yen, and the market is waiting for

- The weakness of non-US currencies resonates with short-selling rebound. Can the

- Guide to short-term operation of major currencies on July 28

- How does the uncertainty of Japanese banks' policy affect the foreign exchange m

- Gold, rebounded short at 3380!

market news

Gold surges higher and falls, the daily line moves in a circle, and it needs to test the short-term 5-day period before stabilizing

Wonderful introduction:

Without the depth of the blue sky, you can have the elegance of white clouds; without the magnificence of the sea, you can have the elegance of the creek; without the fragrance of the wilderness, you can have the greenness of the grass. There is no bystander seat in life. We can always find our own position, our own light source, and our own voice.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: Gold surges higher and falls, the daily line moves in a cycle, and it needs to test the short-term 5-day period before stabilizing". Hope this helps you! The original content is as follows:

Zheng's point of view: Gold has risen and fallen, the daily line is cyclical, and it will test the short-term 5-day stability again

Reviewing yesterday's market trends and technical points:

First, gold: Yesterday, gold was unilaterally shorted and pulled up by more than 100 meters, which is very impressive; in the morning, relying on 3995, a direct sun surged to 4060, the high point before last week , then it is bullish when it steps back above 4020, it continues to be bullish when it steps back on 4045 in the afternoon, and ambush the break of 4061 to chase the rise, because 4060 has been tested four times, and it is easy to continue if it breaks above, especially the unilateral market, and finally successfully reaches the target resistance of 4080; the European market's step back confirms that 4060 is a top and bottom support and continues to be bullish, and it repeatedly pulls up to reach above 4080; while the US market research report points out that the European market is strong, and there will be a second rise. , it is a pity that the first support 4065 has not been tested, and it can easily break through the 4100 mark if it continues to rise. This kind of strength has led to a unilateral rise. The most www.xmmen.comfortable thing must be to buy the bottom position in multiple bands, and the profit increases rapidly;

Second, silver: In the morning, it relied on the hourly mid-track 50 support to be bullish. The price was slightly worse by 0.1, and it rose to 51.7 in a wave. The European market fell back to 50.5 and continued to rise, and the price was just right. In place, the U.S. market continued to rise, hitting the 52.4 line as high as possible, which is also very strong;

Today's market analysis and interpretation:

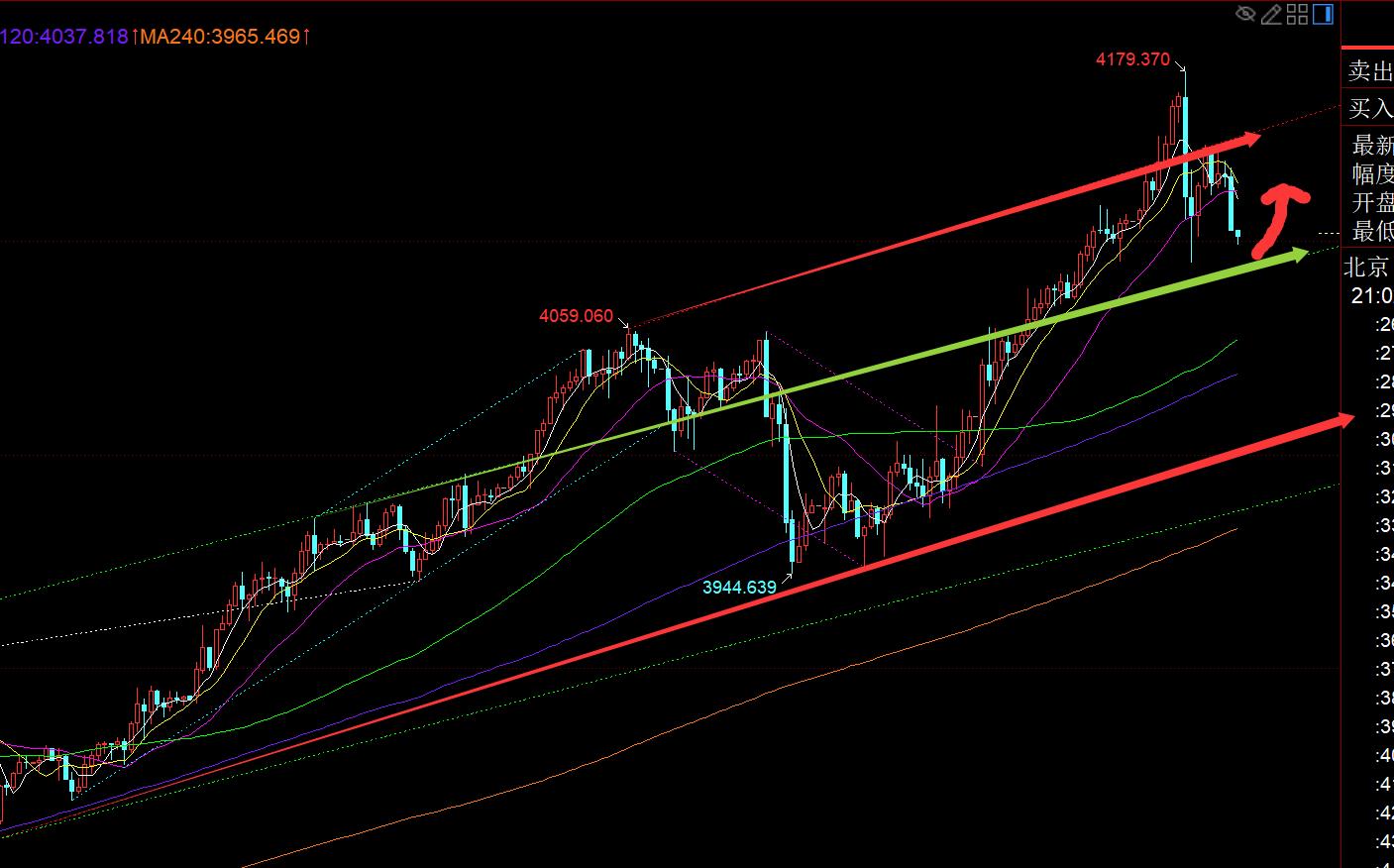

First, the golden daily level: The movement is still large today, it first pulled up 70 meters in the morning, dived 90 meters in the afternoon, the European market retreated 50 meters, and the US market suppressed 40 meters at this time, oscillating violently up and down, forming a long upper shadow K at this time. If it cannot counterattack tonight, it willIt means that we will continue to lower tomorrow, consider the short-term 5 moving average, or pierce it, and then seek to stabilize; starting from September 22, it has been following a similar trend pattern cycle. When a big Yang breaks through the previous sideways pressure level, it is followed by four trading days of high consolidation, and then continues to have a big Yang to break the high. After another four trading days of consolidation, there is another big Yang, and it has gone through three cycles. Yesterday's Dayang K was The fourth time it appears, it may also go into a fourth cycle; therefore, after the big positive K, the second K will generally continue to close the positive, and the third or fourth K will step back to confirm that the 5-day moving average support is effective, and the fifth K will continue to be positive; therefore, today it is expected that it is unlikely to directly test the 5th day, and the closing price should also be above the opening price of 4110.6 to close the positive K;

Second, the golden hour line level: In the afternoon, the 4179 line dived to 4090, which was also the low point last night. After the double bottom stabilized, the European market rebounded to 4145, testing the 618-divided resistance of the decline, which is also red in the chart. The channel counter-pressure point; and the original European market believed that the rebound has returned to the mid-track, and the entire European market is rebounding and has not continued to weaken in the afternoon, then the overall situation is still somewhat strong, and there is a probability of breaking through the resistance of 4045, and then suppressing the intraday high and then rising higher and falling, similar to 1 Movement on October 9th; in the end, the actual trend was not like this, but chose to suppress again, falling below the middle track, and fell to 4100; then what Bollinger took away now was to shrink and consolidate, the lower support line of 4090 is more critical, the upper middle track resistance of 4124, and the red channel The counter-pressure point is 4150, so pay attention to finishing within the range of 4090-4150; personally, I don’t think it will fall below the intraday low and directly test the daily 5-day moving average. If so, just wait until the Asian market stabilizes tomorrow and find a low to go bullish;

Silver: The European market fluctuated and suppressed a wave, touching the support of the lower rail of the yellow channel at 51 in the chart. It rebounded for a wave, and then suppressed and broke a new low to 50.5. This position gradually approached the daily 5-day moving average of 50.3; therefore, As for silver, it has some signs of a one-step correction, and as long as the daily line remains above the 5th, it will still be a strong unilateral slow rise; therefore, pay attention to 50.3 tonight for a stable bullish rebound; or it may break through 51 again and return to the yellow channel , then step back to confirm that the lower track has stabilized to follow the rebound and shock, the resistance is 52 clicks;

The above are several views of the author's technical analysis, as a reference, and also a summary of the technical experience accumulated from watching and reviewing the market for more than 12 hours a day for more than 12 years. Technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can www.xmmen.compare and reference based on the actual trend; those who agree with the idea can refer to the operation, take good defense, and risk control first; those who do not agree can just ignore it; thank you allSupport and attention;

[The article’s opinions are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, set losses strictly, control positions, risk control first, and be responsible for profits and losses]

Writer: Zheng’s Dianyin

Reading and researching the market for more than 12 hours a day, insisting on ten years, detailed technical interpretations are open to the entire network, and serve with sincerity, dedication, sincerity, perseverance, and wholehearted service to the end! Write www.xmmen.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Decision Analysis]: Gold rushes high and falls, the daily line goes in a cycle, and it is necessary to test the short-term 5 days before stabilizing". It is carefully www.xmmen.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Spring, summer, autumn and winter, every season is a beautiful scenery, and they all stay in my heart forever. Slip away~~~

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here