Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- With the fiscal turmoil again, can the pound stabilize its rise?

- Bearish pressure intensifies after the US dollar index falls below the 50-day mo

- Non-agricultural aftershocks! The 10-year U.S. Treasury yield is on the verge of

- ADP encounters "aesthetic fatigue" in the market? 103,000 jobs only triggered a

- Gold is still bullish! 3351 is still the key!

market analysis

[Hot Spots] The “gold” storm is sweeping across the country, and precious metals are outperforming others in terms of gains

Wonderful introduction:

Life requires a smile. When you meet friends and relatives, smiling back can cheer up people's hearts and enhance friendship; accepting help from strangers and smiling back will make both parties feel better; give yourself a smile and life will be better!

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: [Hot Spot Focus] The "gold" storm is sweeping, and the price of precious metals is the highest among the others." Hope this helps you! The original content is as follows:

Precious metals are “killing” like crazy this year!

Spot gold and silver both hit record highs this week, with full-year gains of 56% and 75%, and both are hitting their ninth consecutive week of weekly gains. The full-year gains for platinum and palladium are even more impressive. This crazy trend has left other major assets such as the Hang Seng Index, S&P 500 and crude oil far behind (chart below).

Looking back at history, gold reached the milestone of US$1,000 per ounce in March 2008, hit US$2,000 in September 2020, climbed to US$3,000 in May 2025, and only five months later, it exceeded US$4,000 in October 2025. What factors are driving the astonishing rise?

The Federal Reserve’s easing expectations

The Federal Reserve resumed interest rate cuts in September, with the interest rate range reduced to 4%-4.25%. The dot plot predicts that there will be two more interest rate cuts this year, in October and December, and the terminal interest rate may drop to 2.75%-3% in March 2027.

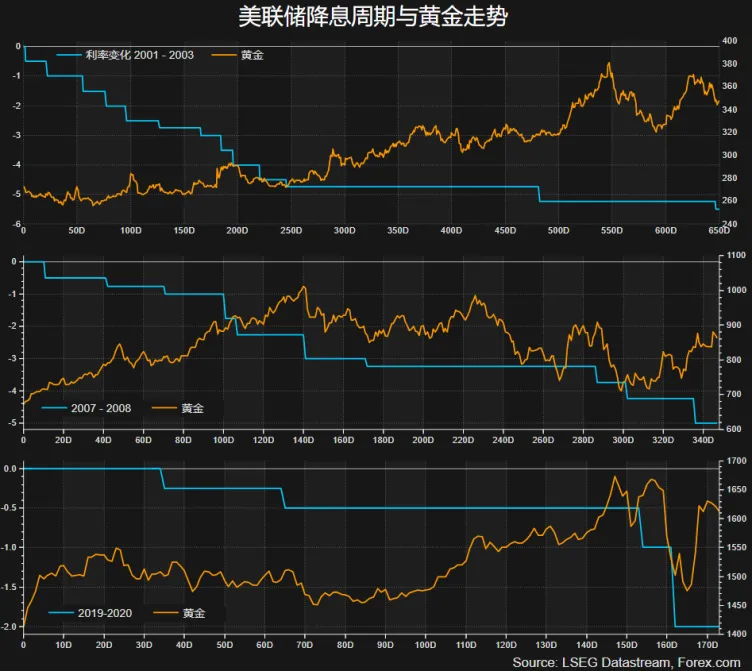

In the three interest rate cut cycles since 2000, gold prices have hit record highs at that time, which shows the stimulating effect of low interest rates on gold prices.

In addition, as the size of the Federal Reserve’s overnight reverse repurchase has increased fromThe peak of US$2.6 trillion in 2022 has dropped to almost zero. Banking industry reserves once fell below US$3 trillion, close to the warning line, and the market sounded a liquidity alarm. Therefore, Powell said in his speech on Tuesday that he is considering ending the balance sheet reduction (QT), and the market estimates the time point will be January next year. If interest rates are cut and the balance sheet reduction is stopped (or even converted to quantitative easing) at the same time, abundant market liquidity is expected to continue to boost the performance of gold and other precious metals.

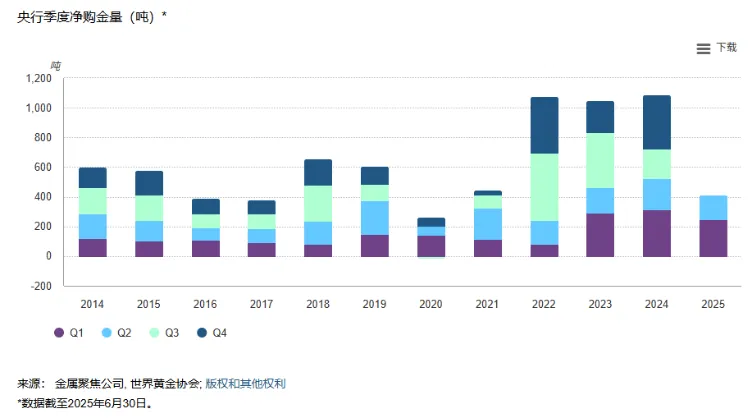

Demand from global central banks continues unabated

Global central banks play an important role in the sources of gold demand.

Since the outbreak of the Russia-Ukraine conflict in 2022, the central bank's annual net gold purchases have exceeded 1,000 tons for three consecutive years, far exceeding the 2010-2021 average level of 481 tons. And this momentum shows no signs of slowing down in 2025. Emerging market countries are the main buyers of gold, among which China has increased its gold reserves for 11 consecutive months.

For the central bank, gold’s natural safe-haven properties can help it hedge against risks such as economic slowdown, inflation, currency depreciation, and geopolitical conflicts, and can also diversify its investment portfolio.

More importantly, the tariffs and sanctions wielded arbitrarily by the U.S. government and the unsustainable debt burden have forced all countries to seriously examine the necessity of "de-dollarization." At least from the first half of this year, gold is obviously a more suitable safe-haven asset choice than the U.S. dollar and U.S. Treasuries.

Not only is the central bank hoarding gold crazily, but if the above risks exist for a long time, individual and institutional investors will also have to increase the allocation of gold in their investment portfolios.

Goldman Sachs raised its target price for gold in 2026 to $4,900, and Bank of America even called out $5,000.

The new normal of the geopolitical situation

Trump 2.0's tariffs and the "America First" strategy have www.xmmen.completely changed the inherent pattern of global economy, trade, diplomacy and other fields. The all-round www.xmmen.competition between China and the United States will undoubtedly be the main theme for a long time to www.xmmen.come. Therefore, "fighting (such as trade wars, port fees, export controls, etc.) while negotiating" may become the new normal. However, this is a huge uncertainty and risk for the global economic outlook, and may continue to highlight the safe-haven properties of gold.

Spot market liquidity crisis?

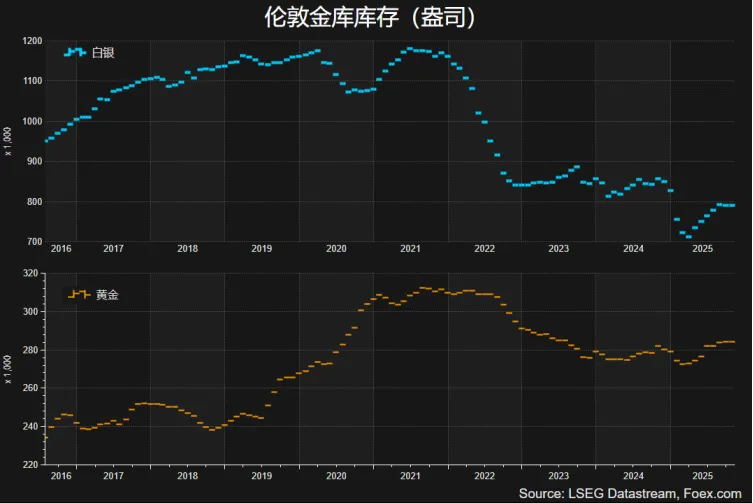

If the above-mentioned factors that stimulate the rise of gold prices and other precious metals are medium to long-term, then the sharp decline in precious metal inventories in the London market is the main reason for the short-term acceleration of price increases.

Silver inventories have dropped by 1/3 www.xmmen.compared with the peak in 2021, and most of them have been locked in growing ETF positions, so liquidity is close to drying up. London silver spot prices and New York futures prices at the start of the weekUnprecedented levels of premiums have emerged. Although there are large New York silver stocks being shipped to London, the madness in silver may continue in the short term, driven by strong investment/speculation and industrial demand. However, silver traders also need to be aware of the callback risk brought about by excessive speculative attributes.

Relatively speaking, the decline in gold inventories is not that extreme. And because gold is an official reserve asset and is easy to store and transport, its future upward trend may be more sustainable.

If it falls below the trend line, it may test the 4090-4100 area, which is Tuesday's intraday low.

It is worth noting that gold has risen for 8 consecutive weeks, and since 1981, the longest consecutive rise in gold prices was 9 weeks, which occurred in 2006 and 2020 respectively.

The above content is all about "[XM Foreign Exchange Platform]: [Hot Spot Focus] The "Gold" storm is sweeping, and the increase in precious metals is unparalleled." It is carefully www.xmmen.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here