Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Practical foreign exchange strategy on August 25

- Trump announces about 100% tariffs on chips, gold prices are affected by investo

- 8.21 Gold bottomed out and rebounded and returned to the oscillation zone, selli

- What's wrong with the euro? European Chemical Industry is trapped in a double ki

- Many countries are sprinting for trade negotiations with the United States, whil

market analysis

Gold maintains strong rise, Europe and the United States pay attention to adjustments

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market www.xmmen.commentary]: Gold maintains a strong rise, Europe and the United States pay attention to adjustments." Hope this helps you! The original content is as follows:

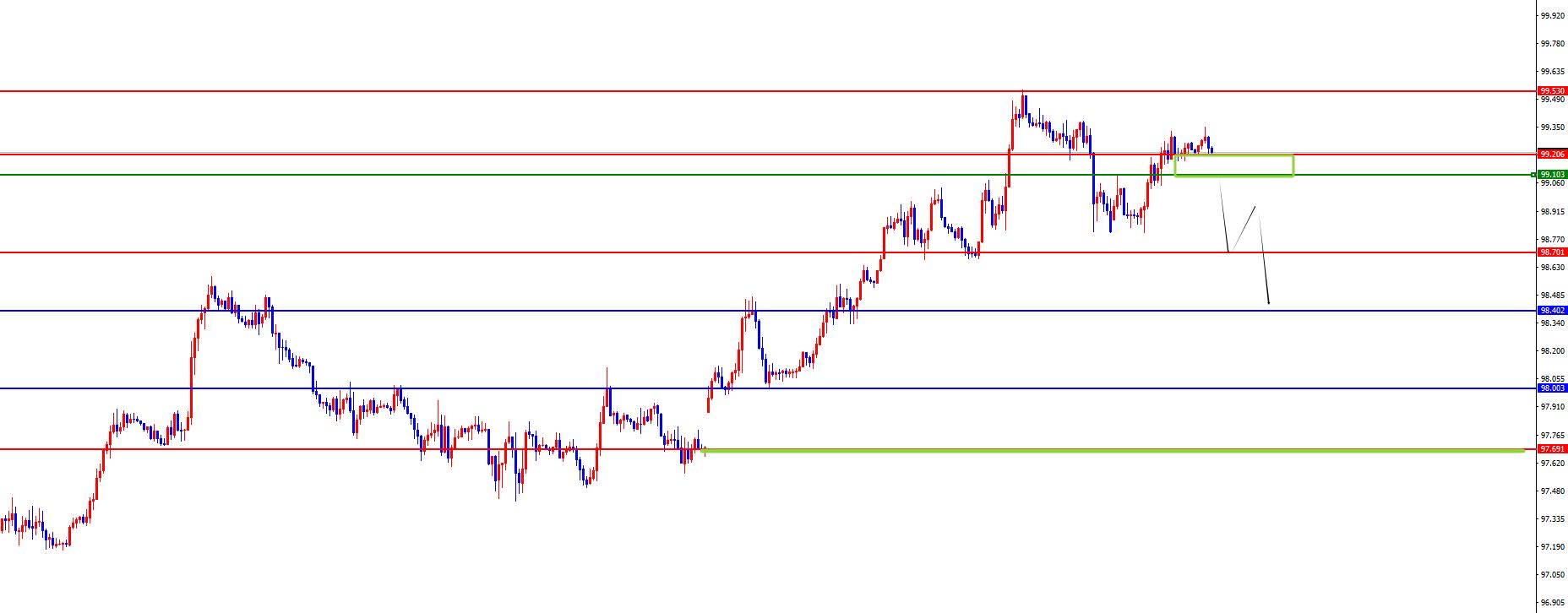

U.S. Dollar Index

In terms of the performance of the U.S. Dollar Index, the U.S. Dollar Index showed an upward trend on Monday. The U.S. dollar index price climbed to a maximum of 99.325 that day, dropped to a minimum of 98.808, and finally closed at 99.231. Looking back at the overall performance of the market on Monday, the price was first under short-term pressure on the four-hour resistance during the early trading, and then pulled up in the European market. Although the day finally closed positive, it is currently cautious to pursue bulls and focus on short-term adjustments.

From a multi-cycle analysis, the weekly price stabilized last week after continuing to fluctuate in the early stage. The current weekly support is in the 98 area, and follow-up attention will be paid to further mid-term bulls. From the daily level, as time goes by, the current daily support is in the 98.40 area, and the price range above this position will rise further. From a four-hour perspective, when the price fell below the four-hour support last Friday, it was under short-term pressure. At the same time, we need to pay attention to the gap position last week. The current four-hour resistance is in the 99.10-20 range. The price will consolidate up and down at this position in the short term. We will continue to pay attention to this position for further falls below to initiate short-term adjustment actions. Prices are also under pressure on the hour. Therefore, based on the overall view, radicals are currently under pressure based on last week's high point near today's early trading. Conservatives can wait for it to fall below 99.10 before following.

Radicals: Look for correction below last week's high, and look for acceleration after falling below 99.10

Conservatives: Look for continuation after falling below 99.10.

Gold

In terms of gold, the price of gold generally showed an upward trend on Monday, and the price on that dayThe highest rose to 4116.89, the lowest fell to 4003.76, and closed at 4110.44. In view of the fact that the price continued to rise strongly during early trading on Monday, and then showed a strong performance during the day, and finally closed very strongly that day, the daily line showed a positive state.

From a multi-cycle analysis, first observe the monthly rhythm. From a long-term perspective, the 3130 position is the watershed of the long-term trend. The price can be treated as long as it is above this position. From the perspective of the weekly level, the current watershed between long and short weekly lines is at 3585, and the price can be treated as long as the midline is above this position. From the daily level, we need to pay attention to the support of the 3932 area for the time being, and the bands above this position should be treated more. From a four-hour perspective, the low point reached during yesterday's early trading is the four-hour key support. After the price fell back, it maintained a strong rise. The current four-hour support is in the 4073-4075 area. The price can stay at this position and treat it more. On the hour, the hour continues to emphasize the extremely strong concept. At the same time, the recent strong rising time points are all in the Asian market, so the opportunity must be seized during the Asian market. Otherwise, it will be difficult to defend during intraday operations, or enter the market after a small adjustment in 15 minutes.

Gold's early trading low of 4106 is the watershed during the day. Prices above this position will see bullish continuation

Europe and the United States

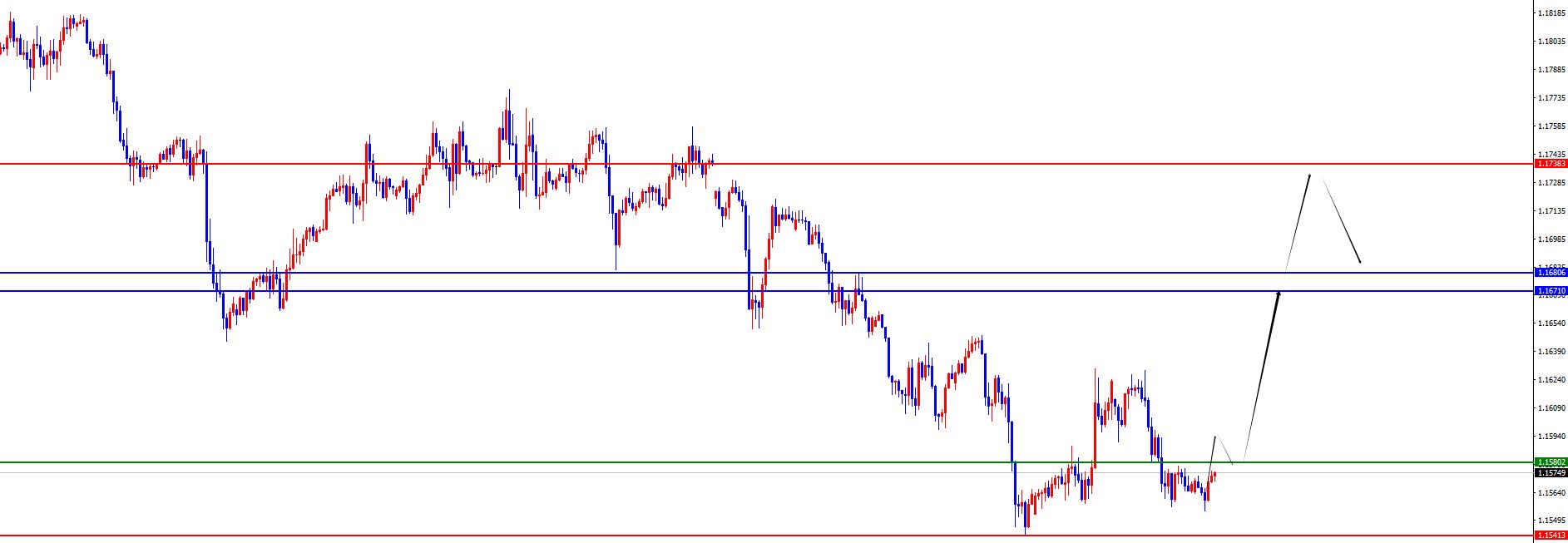

In Europe and the United States, European and American prices generally showed a decline on Monday. The price fell to the lowest position of 1.1557 on the day, rose to the highest position of 1.1629, and closed at 1.1568 position. Looking back at the performance of the European and American markets on Monday, prices fluctuated in the short term during the early trading, and then the European market came under pressure. Finally, the day ended with a heavy cloud. However, for now, do not blindly look at the continuation of short positions, as prices have shown signs of adjustment and shock.

From a multi-cycle analysis, from the monthly level, Europe and the United States are supported at the 1.1100 position, so the price is treated as a long-term position above this position. From a weekly perspective, the price is supported by the 1.1680 area. This position is the long-short watershed of the mid-line trend. It has broken down last week, so we are temporarily concerned about the pressure in the mid-term. From the daily level, the daily line is the key for us to emphasize the band trend. The current daily resistance is at 1.1670, and the price will continue to be under pressure in the band below this position. From a four-hour perspective, it broke through the four-hour resistance last Friday and consolidated at the four-hour key position on Monday. It is still showing an upward adjustment in the four hours, so in the short term, as long as it stands above 1.1580, the correction will continue. There is also a rebound performance in the one hour, so do not chase shorts at the moment, and focus on adjusting the shock performance in the short term.

Radical: Europe and the United States have a long range of 1.1560-70, and will see acceleration after breaking through 1.1580

Conservative: WaitArrange after breaking through 1.1580

[Today’s financial data and events of focus] Tuesday, October 14, 2025

① To be determined is the meeting between US President Trump and Argentine President Milley

② To be determined is the visit of Bank of Japan Governor Kazuo Ueda to the United States

③08:30 The Reserve Bank of Australia releases the minutes of the September monetary policy meeting

④14:00 German September CPI final monthly rate

⑤14:00 British ILO unemployment rate for the three months of August

⑥14:00 British September unemployment rate

⑦14:00 Number of people applying for unemployment benefits in September in the UK

⑧16:00IEA releases monthly crude oil market report

⑨17:00 German October ZEW Economic Sentiment Index

⑩17:00 Eurozone ZEW Economic Sentiment Index in October

18:00 US September NFIB Small Business Confidence Index

20:45 Fed Governor Bowman delivers a speech

21:00IMF releases global economic outlook report

The next day at 00:20 Fed Chairman Powell delivers a speech

Bank of England Governor Bailey gave a speech at 00:30 the next day

Fed Board Governor Waller gave a speech at 03:25 the next day

Fed Collins gave a speech at 03:30 the next day

Note: The above are only personal opinions and strategies, for reference and www.xmmen.communication only. They do not give any investment advice to customers, have nothing to do with customers' investments, and are not used as a basis for placing orders.

The above content is all about "[XM Foreign Exchange Market www.xmmen.commentary]: Gold maintains strong rise, Europe and the United States pay attention to adjustments". It is carefully www.xmmen.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

In fact, responsibility is not helpless or boring, it is as gorgeous as a rainbow. It is this colorful responsibility that creates the wonderful life we have today. I will try my best to organize the article.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here