Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- After the non-farm upset in the United States in July, why did the pound rise sh

- Powell hawks expect to support the dollar's strength, analysts suggest US and Ja

- Trump's tariff storm escalates, analysis of short-term trends of spot gold, silv

- Gold still fluctuates after it rises!

- Trump's tariffs are approaching, and US crude oil stops falling and rises hidden

market analysis

Risk aversion deepens and hits new highs, gold and silver sun extends lower

Wonderful introduction:

You don’t have to learn to be sad in your youth. What www.xmmen.comes and goes is not worth the time. What I promised you, maybe it shouldn’t be a waste of time. Remember, the icy blue that stayed awake all night, is like the romance swallowed by purple jasmine, but the road is far away and the person has not returned. Where does the love stop?

Hello everyone, today XM Forex will bring you "[XM Forex Platform]: Risk aversion deepens and reaches new highs, gold and silver sun extends lower and more". Hope this helps you! The original content is as follows:

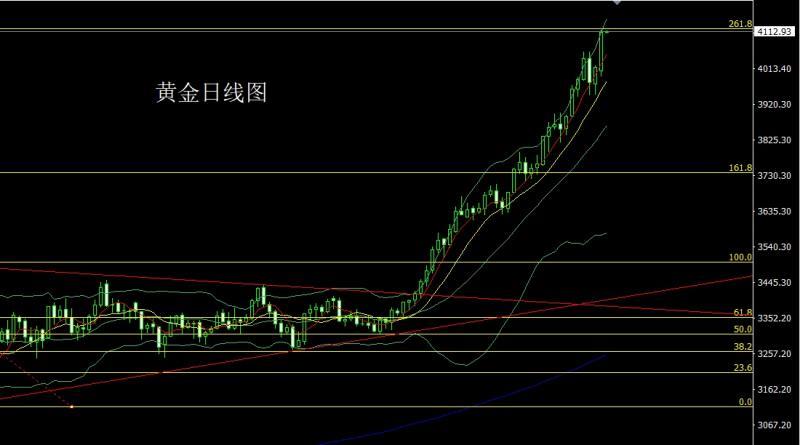

Yesterday, the gold market continued to rise driven by risk aversion. It opened low at 4008.9 in early trading and then fell first. The daily minimum reached 3993.8, and then the market fluctuated strongly and rose. It broke the position and gave strong weekly gains. After reaching the historical high of 4060, the market accelerated its upward trend. The daily line reached its highest point of 4117.1, the technical pressure point of this round, and then the market consolidated at a high level under pressure. After the daily line finally closed at 4111.5, the daily line has a longer lower shadow line. The big Yang line closes, and after the end of this form, today's market has the technical demand to continue to be bullish. In terms of points, the bottom is 3325 and 3322, and last week's 3368-3370 is long, and 3377 and 3385 are long, and 3563 is long and minus. The stop loss follow-up after the position is held at 3750. Today's market is back to 4070 and the stop loss is 4063. The target is 4085, 4110 and 4120 pressure. If the position is broken, look at 4140 and 4150-4155.

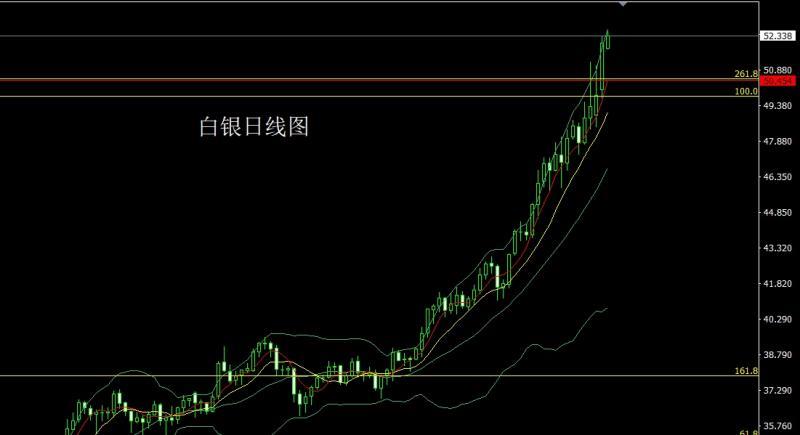

The silver market opened higher yesterday at 50.054. After the market closed the gap and reached 49.7, the market rose strongly. The daily line reached the highest position of 52.295 and then the market consolidated. The daily line finally closed at 52.026 and then the market closed with a big positive line with equal lengths of upper and lower shadows. After such a form ended, today's market has continued to be bullish, and the price pointOn the top, the bottom is 37.8 long, 38.8 long and 44.6 long. After reducing the position, the stop loss is followed up at 47. Today, the 51.2 long stop loss is 50.9. The target is 52 and 52.3, and the breakout is 52.6 and 53.

European and American markets opened low yesterday at 1.16091, and then the market first pulled up to reach a daily high of 1.16300, and then fell back under pressure. The daily low reached a position of 1.15565, and then the market consolidated. After the daily line finally closed at 1.15678, the daily line It closes with a barcode line with a long upper shadow line, and after such a daily double-yin and yang pattern ends, the short stop loss is 1.16350 at 1.16100 today, and the target is 1.15900 and 1.15600. If it falls below, 1.15300 and 1.15100.

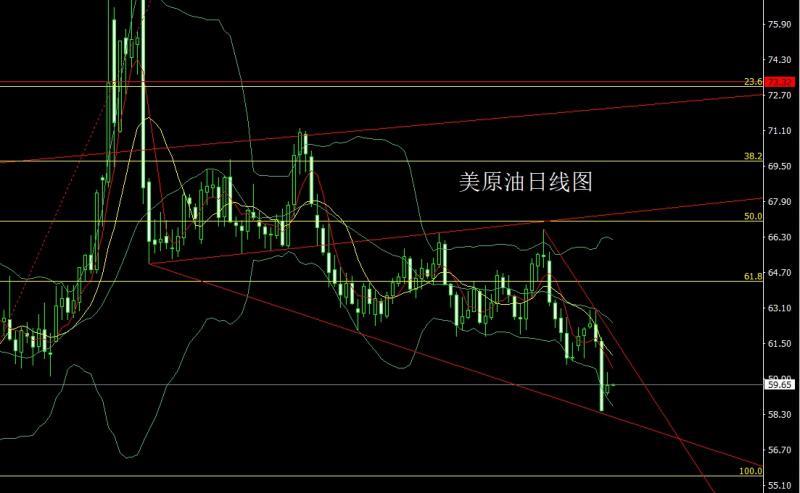

The U.S. crude oil market opened higher yesterday at 59.29, then the market retreated slightly to reach the daily low of 59.17, and then the market fluctuated and rose. The daily high hit the position of 60.21, and then the market surged higher and fell back. The daily line finally closed at After reaching the position of 59.58, the market closed with a harami-line inverted hammer pattern. After this pattern ended, today it first pulled up and gave a short stop loss of 60.8 and a target below 61.3, looking at 60, 59.1 and 58.5-58.

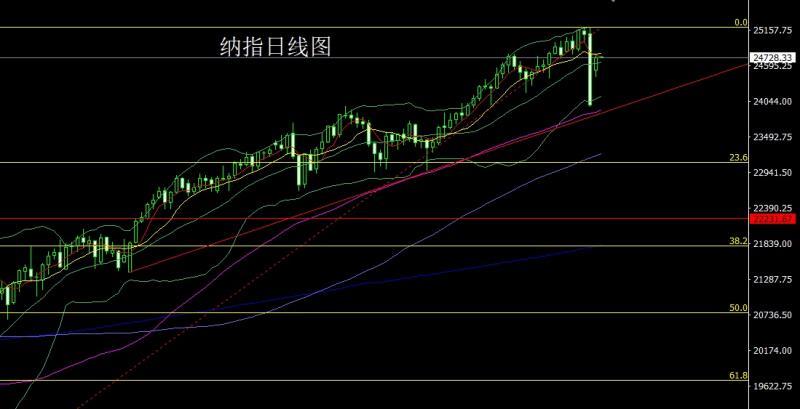

The Nasdaq opened higher yesterday at 24529.56 and then the market fell first. The daily line reached the lowest position of 24431.15 and then the market fluctuated strongly and rose. The daily line reached the highest position of 24782.16 and then the market consolidated. After the daily line finally closed at 24721.69, the daily line has a Zhongyang line with a lower shadow line longer than the upper shadow line. The closing line, and after such a pattern ends, the stop loss is more than 24540 today, and the target is 24720, 24800, and 24850.

Fundamentals, yesterday’s fundamentals, Philadelphia Fed Chairman Paulson hinted that she is inclined to cut interest rates twice more this year, by 25 basis points each time, because the impact of tariffs on rising consumer prices should be ignored when formulating monetary policy. "The key thing for me is that I don't see the kind of conditions that would allow tariff-induced price increases to turn into persistent inflation - especially on the labor market side," Paulson said. Policymakers' decision to cut interest rates by 25 basis points last month "made sense," Paulson said. In the case of moderate tightening of monetary policy, she advocated easing monetary policy along the lines of the Fed's last summary of economic forecasts. The median of those forecasts supports two more rate cuts by the Fed by 25 basis points each before the end of the year. she added, if the economy develops as I expect, our monetary policy adjustments this year and next will be sufficient to bring labor market conditions close to full employment. The leaders of the four mediating parties, Egypt, the United States, Qatar and Türkiye, signed the "Comprehensive Document on the Gaza Ceasefire Agreement." However, the U.S. government is still shut down, and the daily shutdown this time may exceed the longest in history. The previous historical record was 35 days. In addition, the U.S. has once again provoked a trade war with China, and the gold and silver markets have once again reached record highs. Today's fundamentals focus on the release of the minutes of the September monetary policy meeting of the Reserve Bank of Australia at 8:30. At 23:30 in the evening, Federal Reserve Chairman Powell will deliver a speech at an event hosted by the National Association of Business Economics.

In terms of operation, gold: the longs of 3325 and 3322 below, the longs of 3368-3370 last week, the longs of 3377 and 3385, and the longs of 3563. After reducing the positions, the stop loss will be followed up and held at 3750. Today’s market is back to 4070 and the stop loss is 4063. The target is 4085 and 4110 and 4120 pressure, if the position breaks, look at 4140 and 4150-4155.

Silver: 37.8 long, 38.8 long and 44.6 long below. After reducing the position, the stop loss will be followed up and held at 47. Today, the stop loss is 51.2 and 50.9. The target is 52 and 52.3. , if it breaks, look at 52.6 and 53.

Europe and the United States: Today, 1.16100 is a short stop loss of 1.16350. The target is 1.15900 and 1.15600. If it falls below, look at 1.15300 and 1.15100.

US crude oil: Today it will rise first and give 60. 8 short stop loss below 61.3, the target is 60 and 59.1 and 58.5-58.

Nasdaq: today's 24600 long stop loss is 24540, the target is 24720, 24800 and 24850.

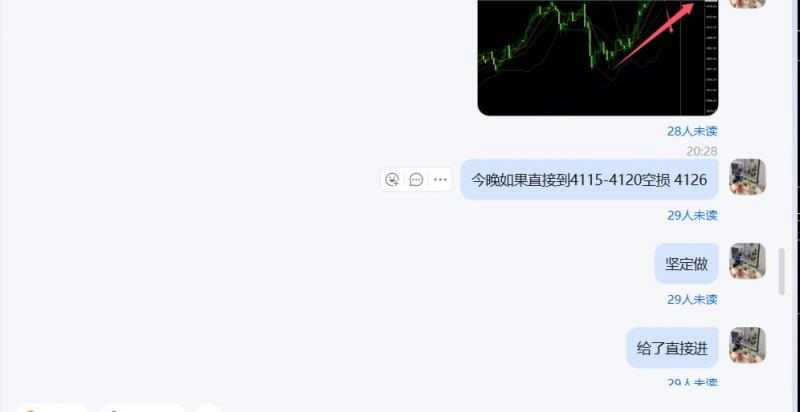

Short 4115 yesterday

The above content is all about "[XM Foreign Exchange Platform]: Risk aversion deepens and reaches new highs, gold and silver sun extends lower and more". It is carefully www.xmmen.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here